Looking to boost your app's visibility and acquire more users? Our 2025 ASO Report is your ultimate guide to navigating the evolving app store landscape. Packed with data-driven insights, keyword trends, and top-ranking app strategies, this report will equip you with the knowledge to optimize your app's presence and achieve organic growth.

Mobile app competitor analysis is one of the most reliable ways to understand how other apps in your category gain visibility, attract traffic, and convert users. When you analyze competitors’ ASO strategy, keyword targeting, creatives, and market signals, you can clearly see what works in your category and where the gaps are. This allows you to make data-driven decisions, improve your search visibility, and build stronger conversion funnels on both the App Store and Google Play.

In this blog post, we explain how to analyze app store competitors step by step. You’ll learn how to identify relevant competitors, evaluate their ASO strategy, review their keyword choices, benchmark their creatives, and understand their market performance. The goal is to give you a practical framework that you can apply directly to your own ASO competitor analysis workflows.

What is mobile app competitor analysis?

Mobile app competitor analysis is the process of evaluating how similar apps rank, acquire traffic, and convert users across the App Store and Google Play. It includes reviewing their metadata, keywords, creatives, ratings, reviews, update, category performance, and paid acquisition signals. By understanding these elements, you can see what drives their visibility and which optimization tactics deliver measurable results.

This analysis goes beyond looking at app rankings. You examine the full picture: the keywords they target, how they localize metadata, how their screenshots influence conversion, how often they update, and which markets they invest in.

When you evaluate competitors’ ASO strategy, you can spot clear opportunities, such as keywords they rank for but you don’t, or recurring visual choices in their screenshots and icons that seem to work well for top-converting apps.

Mobile app competitor analysis also helps you determine market size, user expectations, and category standards. When done consistently, it reveals growth opportunities and provides a clear roadmap for improving your own visibility, acquisition, and conversion rates.

How to identify your app store competitors?

Identifying the right competitors is the foundation of any mobile app competitor analysis. To understand your competitive landscape, you need to look at different types of competitors: keyword-based, category-based, intent-based, and region-specific. Each type provides a different layer of insight into how apps compete for visibility and installs.

Below are the four essential segments you should map before starting any ASO competitor analysis.

1. Keyword-based competitors

Keyword-based competitors are apps that appear for the same search terms as your app. They matter the most in ASO because a large share of installs on both the App Store and Google Play comes directly from search results.

When you analyze keyword competitors, you look at:

- Which apps rank in the top 10 for your primary keywords and related semantic search terms.

- Which keywords drive their visibility

- Where they gain ranking momentum or lose positions

Understanding keyword competitors helps you decide which terms are realistic to target, which require creative or metadata changes, and where opportunities exist.

For example, if an app with a similar value proposition ranks for a high-intent keyword you’re not targeting, that becomes a clear opportunity to expand your keyword footprint.

2. Category-based competitors

Category competitors are the apps you see in your category’s Top Charts, “You Might Also Like,” and “Similar Apps” sections. These apps compete with you for browse, explore, and category placements.

Category-based competitors help you:

- Understand category-level positioning

- Benchmark store creatives in your niche

- Identify top-performing apps by downloads or revenue

- See how frequently leading competitors update

These competitors may not always target your keywords directly, but they shape user expectations in your category.

3. Intent-based competitors

Intent-based competitors are apps that help users achieve the same goal as your app, even if they belong to a different category or use completely different search terms. Users don’t think in categories; they think in problems. So when they look for a solution (like losing weight, saving money, or building habits), they often compare different types of apps that address the same need. That’s why intent-based competitors matter.

Examples:

- A meditation app may compete with sleep sounds apps or breathing exercise apps

- A QR code reader may compete with document scanner apps or file manager apps

- A fitness app may compete with step counter apps or calorie-tracking apps

Audience-intent competitors show which alternative solutions users consider, which keywords overlap across different app types, and which messaging angles they respond to. Analyzing this group helps you understand the full user journey instead of limiting your strategy to apps in the same category.

4. Region-specific competitors

Regional competitors vary by market. An app that ranks well in the U.S. may not dominate in Germany, India, or Brazil. Localized competitors often optimize for region-specific keywords, languages, and cultural expectations.

Analyzing these competitors helps you identify which apps lead in each market, understand regional keyword trends, benchmark localized metadata and creatives, and spot markets where competition is weaker or stronger.

For example, a finance app might grow quickly in countries where there aren’t many similar apps yet, but in markets like the U.S. or the U.K., it may struggle because strong, well-known competitors already dominate.

MobileAction’s ASO Intelligence makes this easier by letting you filter competitor visibility, keywords, and creatives by country, so you can compare both global and local competitors without switching store regions manually.

How to do a mobile app competitive analysis?

Once you know who your competitors are, the next step is to analyze them in a structured way. This section turns ASO competitive research into a repeatable workflow you can use for any app or market.

You can follow these seven steps in order, or focus on the ones that match your current goals (launch, soft launch, scaling, or repositioning).

Step 1: Evaluate competitor metadata and ASO strategy

Start by reviewing how competitors present their app in the stores. Focus on four main metadata elements to understand their positioning, keyword strategy, and value proposition.

1. App name / title

- Which core keywords do they include?

- Is the app title branded, descriptive, or a mix of both?

- How often do they update or test app title variations?

2. Subtitle (iOS) / short description (Google Play)

- How do they combine high-value keywords with a clear value proposition?

- Are they using feature-based terms (“workout planner”), problem-based terms (“lose weight”), or audience-based terms (“for beginners”)?

- Does the subtitle/short description reinforce the message introduced in the title?

3. Full description

- How do they structure the first 3-5 lines (the part visible before expanding)?

- Do they highlight use cases, features, social proof, or outcomes first?

- How naturally do they integrate keywords without over-optimization or stuffing?

- Which recurring phrases, synonyms, or semantic variations appear?

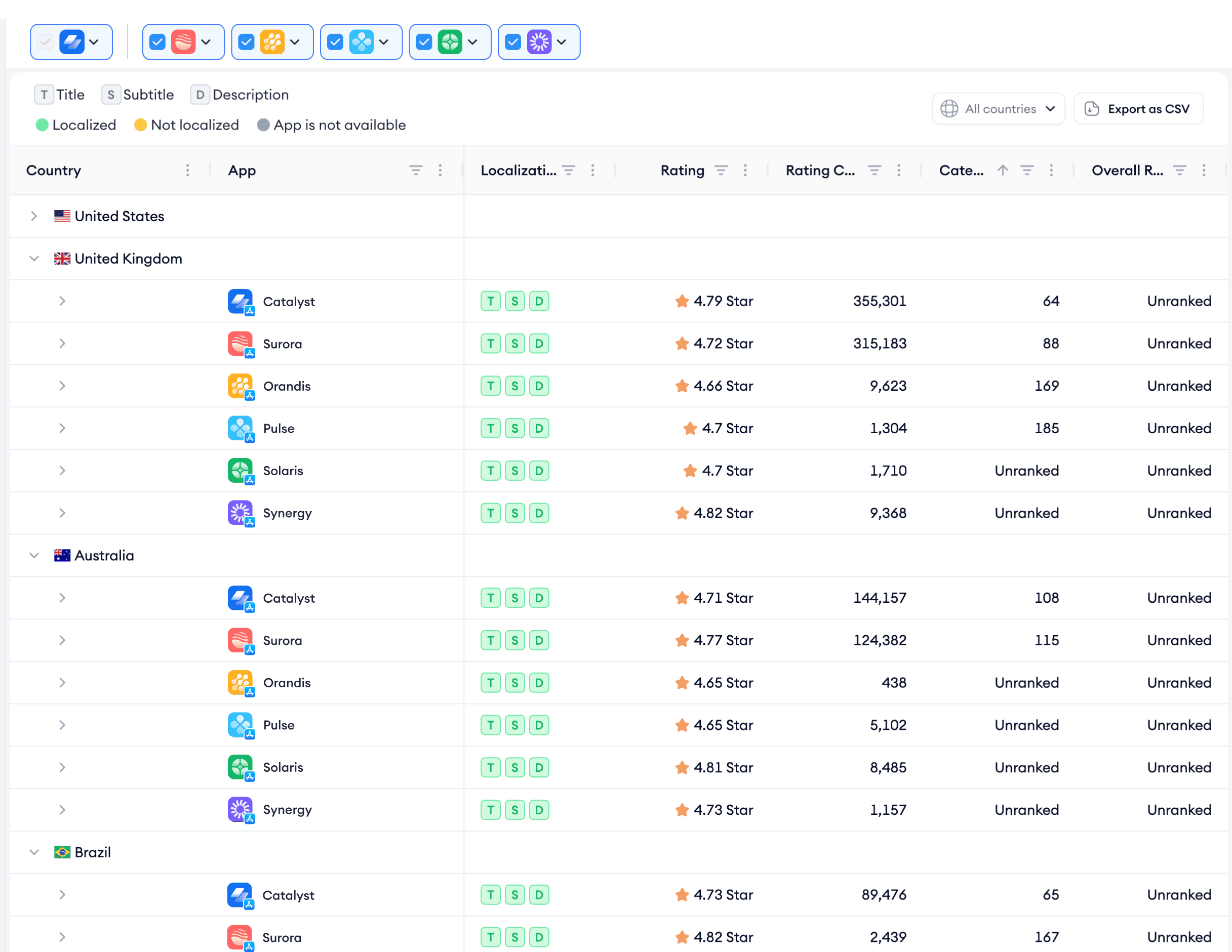

4. Localization

- Do they localize titles, descriptions, and screenshots for top markets?

- Are localized versions direct translations, or are they adapted to local search intent, user behavior, and app localization best practices?

- How consistently do they localize across different markets?

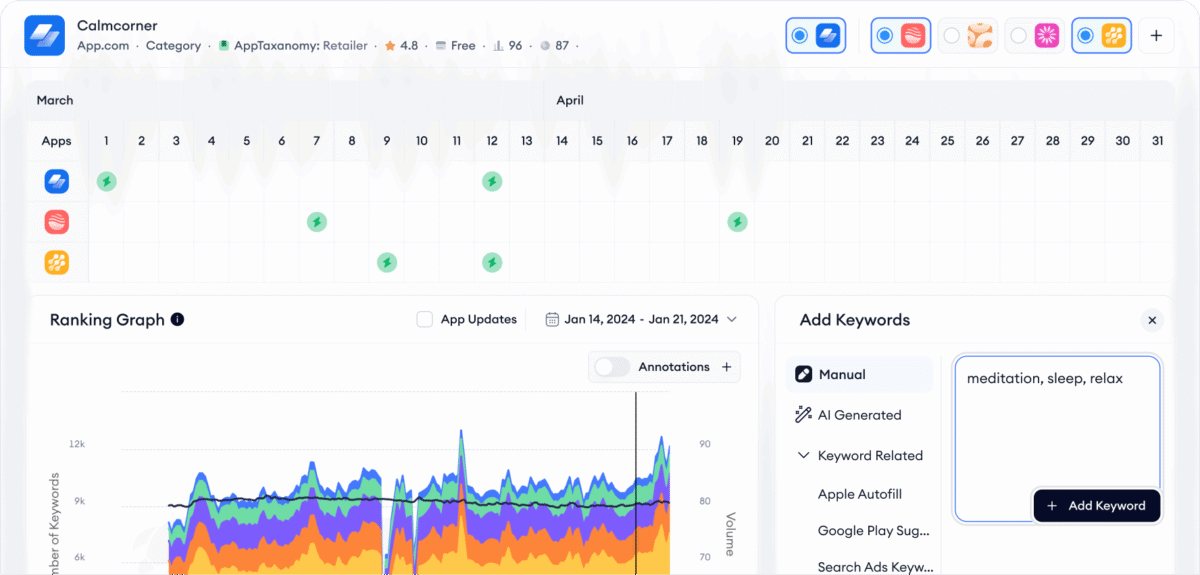

MobileAction’s Localization feature helps you check how strategic and consistent competitors are with multilingual metadata.

Step 2: Analyze competitor store creatives (screenshots, icons, videos)

Next, evaluate how competitors convert traffic into installs through creatives. This is where mobile app competitor analysis often reveals quick wins. Review for each competitor:

1. App icon

- Whether the style uses flat elements, 3D depth, or newer visual systems such as Apple Liquid Glass or Google’s Material You design

- How the color choices perform in search results and how well they align with the brand

- Whether the icon stands out visually among similar apps or looks too similar to the rest

![]()

2. Screenshots

- What they choose to highlight in the first few screenshots

- Whether users can understand the main value within one or two images

- Use of short, scannable text instead of long sentences

- Whether the visuals are UI-focused, lifestyle-driven, or a mix of both

- Use of ratings, awards, or credibility badges

- The overall format (portrait or landscape, single-screen or multi-screen compositions)

3. App preview promo video

- Whether the core value is clear within the first few seconds

- How the app preview is structured (feature walkthrough, story, or use-case flow)

- Whether the video aligns with the promises shown in screenshots and metadata

4. Custom product page & custom store listing creativity

Advanced teams personalize creatives using custom products pages and custom store listings for different intents. You can benchmark how competitors structure these page variations:

- Feature-focused versions

- Seasonal versions

- Audience-specific versions

- Paid campaign-specific versions

MobileAction’s Creative Monitoring, Organic CPP Results and CPP Intelligence help you uncover these without manually checking every competitor page.

Step 3: Uncover competitor keyword targeting

This step connects your mobile app competitor analysis directly to search performance. You want to understand competitor keyword targeting: which terms drive their visibility and how aggressively they cover each intent.

Analyze the following areas:

1. Keyword footprint

- Which keywords do competitors rank for?

- How broad or narrow is their keyword coverage?

- Do they focus on branded, feature, or generic terms?

This helps you understand whether a competitor’s strategy is niche or broad.

2. Ranking strength

Identify:

- Keywords where they consistently appear in the top 1-5

- Competitive keywords where they maintain top 10

- Long-tail terms where they dominate due to relevance

This reveals their strongest and weakest keyword clusters.

3. Keyword difficulty and opportunity

- Which high-volume keywords are they winning?

- Which mid-volume keywords show growth potential?

- Are they ignoring high-intent long-tail terms?

With Keyword Inspector, Competitor Keywords, and Keyword Trends, you can highlight these clearly, especially when comparing multiple competitors side by side.

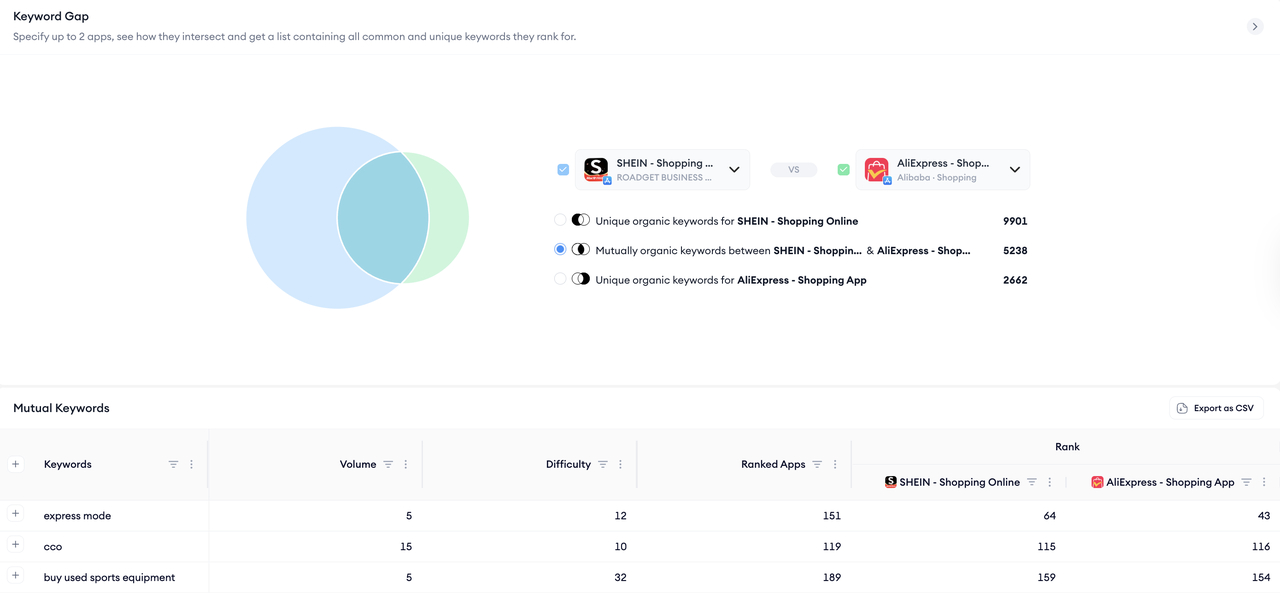

4. Shared vs. unique keywords

- Shared keywords show where you and your competitors target the same search terms.

- Unique keywords show where competitors focus on different terms, which can highlight their strengths or reveal new opportunities for you.

5. Paid keyword signals

Paid keyword signals show where competitors invest the most:

- Which keywords are they bidding on Apple Ads?

- Where do they dominate impression share?

- Are they bidding on branded or generic terms?

SearchAds.com by MobileAction shows which keywords competitors value enough to bid on, how much impression share they capture, and where they invest their paid visibility.

Step 4: Evaluate competitor market and category performance

Now move from keyword-level details to mobile app market analysis. You want to see how each competitor performs within the category and market as a whole.

Key elements to review:

1. Category rankings over time

- Are they stable, growing, or declining?

- Do they spike around specific campaigns, updates, or seasonality?

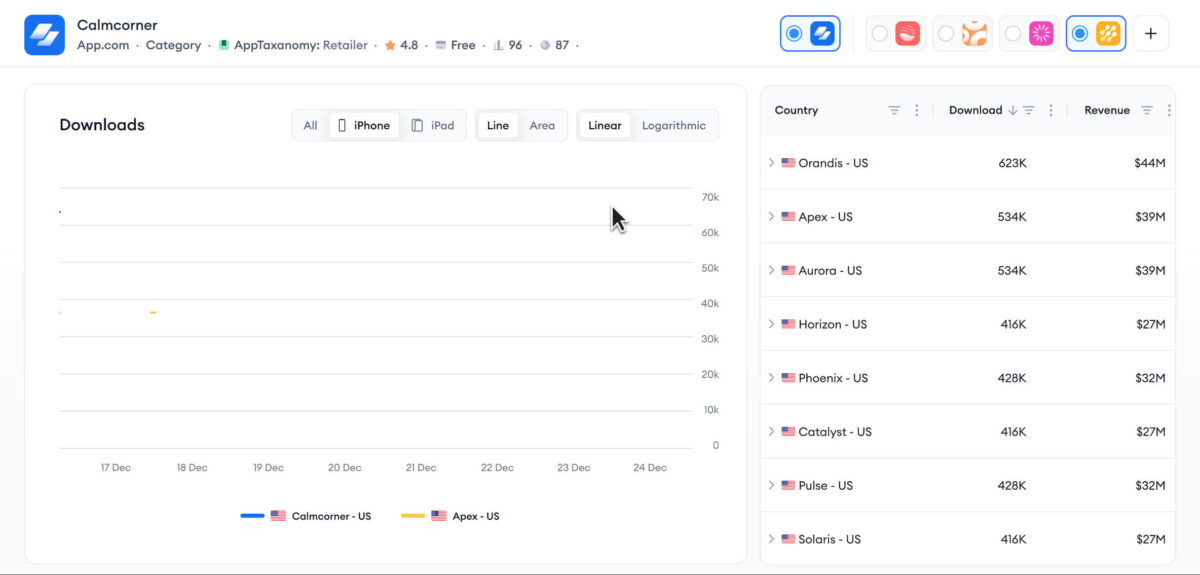

2. Download estimates

- Help you understand whether competitors are large, mid-sized, or small apps

- Show if their downloads are increasing, staying flat, or rising and falling unpredictably

3. Revenue estimates (if applicable)

- Subscription-heavy vs ad-based vs mixed monetization

- Signs of paywall optimizations (e.g., pricing tests, new plans mentioned in “What’s New”)

4. Regional performance

- Which countries drive the majority of downloads or revenue?

- Where do they outperform category averages?

This layer gives you market-level insights that pure ASO data can’t show. It helps you understand situations like a competitor that doesn’t rank highly for many keywords but still gets strong downloads because it performs well across many countries, or a smaller app that ranks for fewer terms but grows quickly in a specific niche or region. It also shows where certain markets are growing faster than your app.

With MobileAction’s Market Intelligence, you can compare downloads, revenue, and rankings across different apps and countries to understand how your ASO performance fits into the broader market.

Step 5: Analyze competitor visibility and conversion signals

You cannot see competitors’ exact conversion rates, but you can infer a lot from their visibility and visible engagement signals. This step connects your mobile app competitor analysis to likely performance outcomes.

Look at:

1. Search and browse rankings

- For key keywords, where do they rank vs you?

- Do they hold top positions consistently or fluctuate?

2. Store visibility footprint

- Number of keywords in which they appear in the top 10 / top 30

- Presence in “similar apps”, “you might also like”, or editorial collections

3. Ratings and reviews

- Average rating and total rating count

- Recent rating trend (improving or declining)

- User feedback themes: UX, performance, pricing, support, feature gaps

4. Conversion hints

- Strong creatives plus high rankings plus many ratings usually suggest solid conversion

- Sudden ranking gains after creative or metadata changes may indicate successful optimization

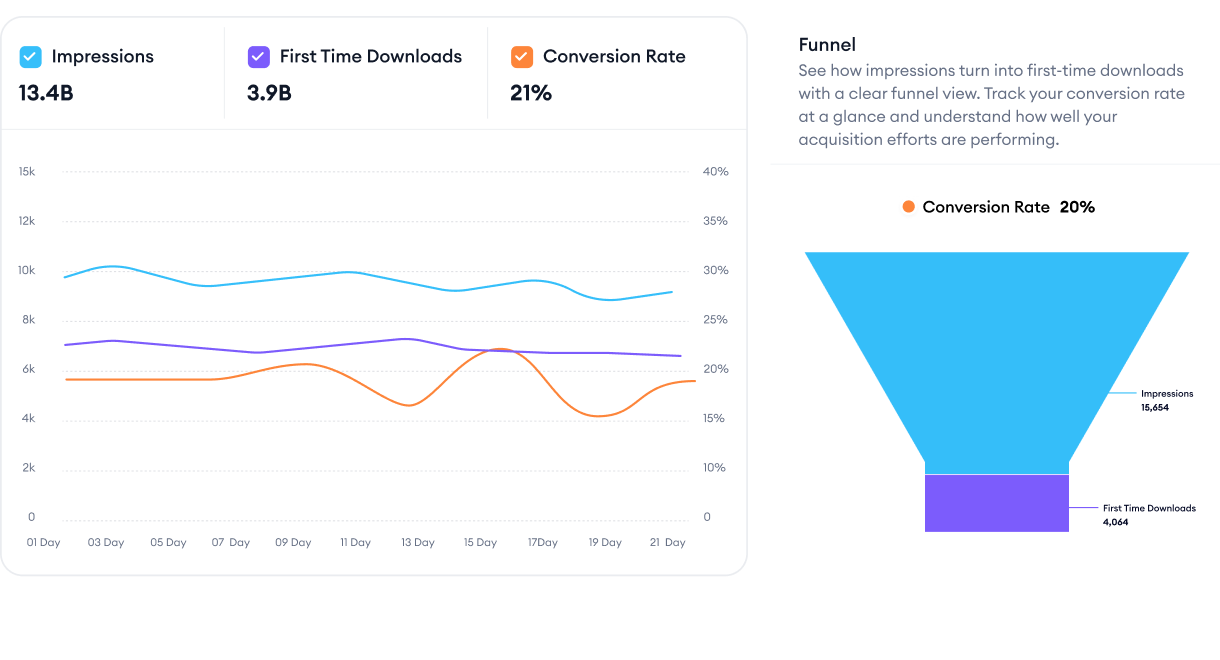

If you connect this with your own funnel data (impressions → product page views → installs), you can estimate how much better your product page needs to perform to close the gap.

MobileAction offers visibility map and conversion funnel views that make it easier to compare your visibility and performance against competitors qualitatively, even if exact competitor CVR is not available.

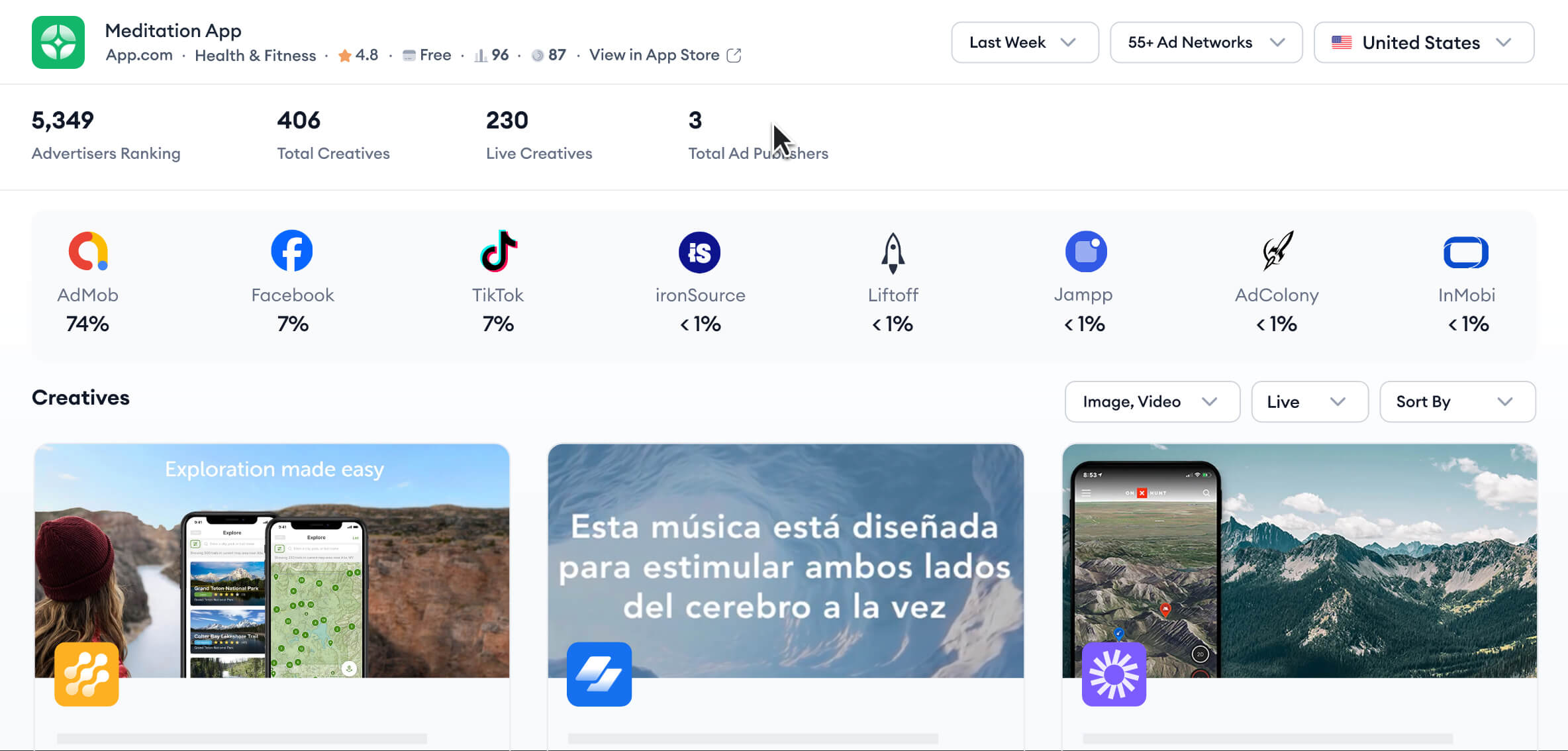

Step 6: Review competitor paid acquisition strategy

A complete mobile app competitor analysis includes both organic and paid. Many top apps rely on a mix of Apple Ads, Google Ads, and ad networks to secure additional traffic for their highest-value keywords and audiences.

Key questions to answer:

1. Which keywords do they buy traffic for?

- Are they bidding on the same keywords they rank for organically, or filling gaps where their organic ranks are weaker?

- How heavily do they invest in branded vs generic terms?

2. How strong is their impression share?

- Do they appear as top advertisers for your key search terms?

- Are they visible across Today tab / Search tab / Product page ad placements on iOS?

3. What ad creatives do they run?

- Do they reuse store screenshots or build ad-specific creatives?

- Are they using custom product pages (iOS) or custom store listings (Google Play) linked to campaigns?

4. Which networks and formats do they use?

- Social, UGC, display, video networks, OEM channels, etc.

- Short-form vs long-form video, static vs animated assets

This is where SearchAds.com by MobileAction and Ad Intelligence become useful. They help you see which keywords competitors pay for, how often their ads appear, and what creatives they use across networks. Combined with CPP insights, you can understand how competitors align paid traffic with tailored product pages.

Step 7: Turn insights into ASO action items

Finally, turn analysis into action. Based on what you’ve discovered:

- Adjust your metadata for better keyword alignment

- Create or localize creatives to match competitive standards

- Fill keyword gaps with new targeting opportunities

- Benchmark your visibility and conversion performance

- Test new strategies like custom product pages or seasonal visuals

Prioritize based on effort vs potential impact. If a competitor dominates a high-volume keyword you’re not ranking for, but your app serves that intent, that’s a clear opportunity.

Common mistakes in mobile app competitor analysis

Even experienced teams make avoidable mistakes when they run mobile app competitor analysis. These mistakes usually lead to wrong priorities, wasted effort, or conclusions that do not match real store dynamics. Below are the most common issues to watch out for and how to avoid them.

1. Only tracking “big brands” instead of real keyword competitors

A frequent mistake in mobile app competitor analysis is focusing only on famous apps in your category. Large brands may dominate overall visibility, but they are not always your most relevant competitors in search.

To fix this mistake, build your competitor list based on keywords rather than brand perception. Start by identifying the apps that consistently appear for your highest-priority search terms, even if they’re smaller or less well-known. Then segment your competitor list into keyword competitors, category competitors, audience-intent competitors, and regional competitors.

2. Copying competitor metadata instead of understanding intent

Another common mistake is treating competitor titles, subtitles, and descriptions as templates to copy.

Use competitor metadata to understand which user intents and queries they are targeting, not as templates to copy. Focus on the messaging behind their titles and descriptions, such as whether they emphasize features, benefits, problems, or solutions. Then create your own strategic response by deciding where it makes sense to align with competitor positioning and where you should intentionally differentiate.

3. Looking only at rankings, not conversion signals

Many teams treat high rankings as the only success indicator in mobile app competitor research. They monitor positions but ignore whether those rankings actually convert into installs.

To fix this mistake, combine ranking data with conversion signals such as ratings, reviews, creative quality, and funnel performance. Instead of assuming high rankings equal success, evaluate whether a competitor actually turns visibility into installs.

4. Ignoring creatives or treating them as a design-only concern

Some teams focus heavily on keywords and metadata but treat icons, screenshots, and videos as secondary. In reality, creatives are central to competitor analysis for app growth.

Make creatives a central part of your competitive analysis. Review competitor screenshots, icons, and videos alongside keyword data to see how they communicate value. Focus especially on their first three screenshots and the messages they highlight. Keep tracking creative updates so you can connect changes in visuals with shifts in ranking or conversion.

5. Mixing regions and markets in one analysis

Another frequent issue is combining global and local data into a single view, especially when analyzing mobile app market analysis.

Keep your competitive research strictly market-specific. Analyze each country or region separately so you can clearly see which competitors matter in that market and how their metadata, creatives, rankings, and reviews differ.

6. Treating paid and organic analysis as separate worlds

Many teams limit mobile app competitor analysis to organic ASO only. Paid channels (Apple Ads, Google Ads, ad networks) are handled separately by UA teams, if at all.

Bring paid and organic insights together instead of treating them as separate workflows. Look at which keywords competitors rank for and which ones they actively bid on, especially in Apple Ads. When you analyse both their metadata and their paid campaigns side by side, you can spot the keywords they truly prioritize and use those combined insights to shape your own metadata and campaign strategy.

Avoiding these mistakes will make your mobile app competitor analysis more accurate, actionable, and aligned with how real users experience the App Store and Google Play.

Conclusion

Mobile app competitor analysis gives you a clear, data-driven view of how other apps gain visibility, attract users, and convert traffic across the App Store and Google Play. When you break the process into structured steps, identifying the right competitors, reviewing their metadata and creatives, uncovering their keyword strategy, analyzing market performance, and evaluating both organic and paid signals, you get a complete picture of the competitive landscape.

This framework helps you see what actually drives growth in your category: which keywords matter, which creative patterns convert, which markets offer opportunity, and which competitors are shaping user expectations. It also shows you where the gaps are, keywords no one is targeting well, markets with low competition, or creative angles that haven’t been explored yet.

Ready to analyze your mobile app competitors more effectively?

Book your demo today and let the experts at MobileAction show you how to grow your app!

Frequently asked questions

How do I find my direct competitors in the App Store and Google Play?

You can find your direct competitors by looking at the apps that appear alongside yours in search results, category rankings, and similar app sections. Start by identifying which apps rank for your core keywords, since these are the competitors that influence your visibility the most. Then review the “Similar Apps,” “You Might Also Like,” and category Top Charts in your niche to see which apps the stores consider alternatives to yours. Finally, check intent-based competitors, apps that solve the same user problem even if they belong to different categories, to understand which apps users compare your solution with.

Which tools are best for conducting mobile app competitor analysis for ASO?

MobileAction provides one of the most complete toolsets for ASO competitor analysis. You can use Competitor Keywords, Keyword Inspector, Keyword Trends, and Metadata Optimizer to understand competitor keyword targeting, ranking strength, and metadata strategy. Tools like Creative Monitoring and Organic CPP Results help you benchmark icons, screenshots, videos, and custom product pages. Visibility Report, ASO Report, and Download Share give you a full picture of how competitors perform across keywords, markets, and devices. For paid insights, SearchAds.com and Ad Intelligence show which keywords competitors bid on and which ad creatives they use. Together, these tools help you analyze competitor visibility, keyword strategy, creatives, and market performance in a single workflow.