Looking to boost your app's visibility and acquire more users? Our 2025 ASO Report is your ultimate guide to navigating the evolving app store landscape. Packed with data-driven insights, keyword trends, and top-ranking app strategies, this report will equip you with the knowledge to optimize your app's presence and achieve organic growth.

If you search for what apps make the most money, you’ll find top-grossing rankings, revenue screenshots, and headline numbers. What’s usually missing is an explanation of why those apps earn so much, and why many apps with millions of downloads never become profitable.

In 2026, the highest-earning apps are not defined by download volume. They are defined by revenue per user, retention, and monetization aligned with user intent.

In this blog post we explain which app categories generate the most revenue today, why top-grossing apps have fewer users than top-downloaded apps, how subscriptions, in-app purchases, and hybrid models perform in practice, and which app ideas are still realistically profitable in 2026.

What apps make the most money today?

The answer depends on how revenue is measured and which monetization models are involved. What matters more than the individual app is the pattern behind top earners.

Across both iOS and Google Play, the highest-revenue apps consistently fall into a small number of categories and share similar economic structures: high willingness to pay, frequent usage, and strong retention.

Which types of apps earn the most worldwide

On a global level, the apps with the highest earnings are:

- Large-scale mobile games built around in-app purchases

- Subscription-based platforms with daily or weekly usage

- Financial apps that monetize access, transactions, or assets

These apps generate revenue continuously, not through one-time purchases. Their income comes from recurring user behavior, not viral growth spikes.

Why the highest-earning apps aren’t always the most downloaded

In fact, many of the most downloaded apps earn relatively little per user. There are three main reasons for this gap:

First, free apps that rely solely on ads need massive, sustained usage to make money. Ad revenue is generated per impression, not per download. If users open the app infrequently or stop using it after a short time, revenue per user stays low. This means that even apps with millions of installs can struggle to generate meaningful income when retention and daily activity are weak.

Second, paid behavior matters more than audience size. Apps that solve high-intent problems, such as dating, fitness improvement, investing, or productivity, attract users who are willing to pay. These apps can earn more with fewer users because their average revenue per user (ARPU) is significantly higher.

Third, usage frequency compounds revenue. Apps that are opened daily or multiple times per week create more opportunities to monetize through subscriptions, add-ons, or in-app purchases.

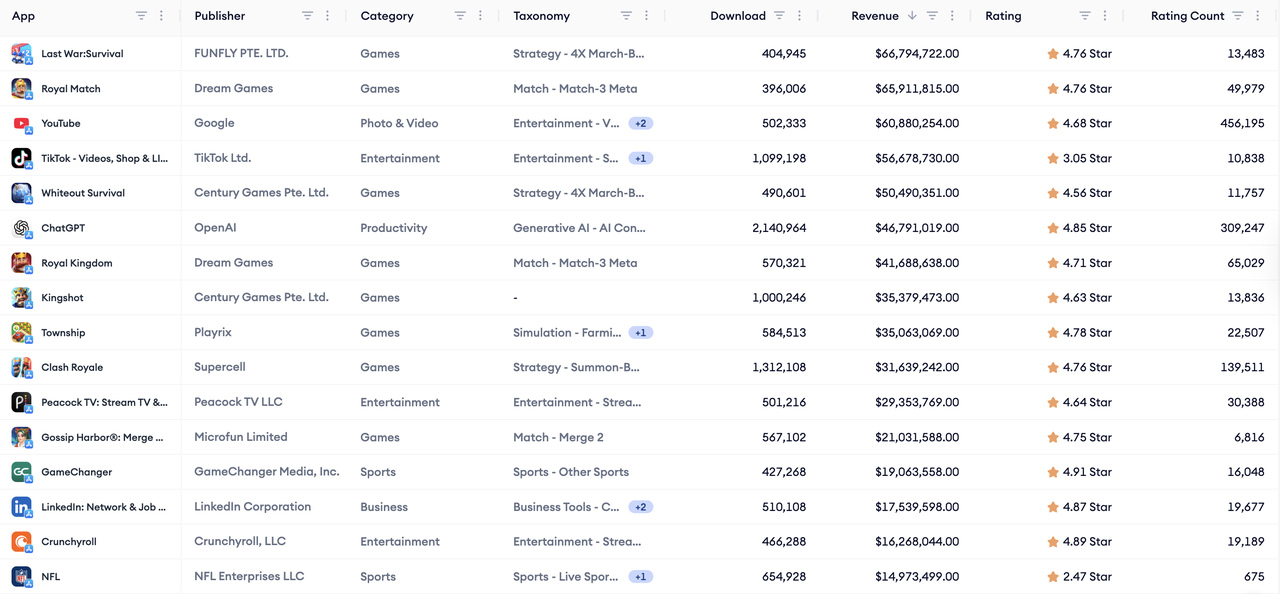

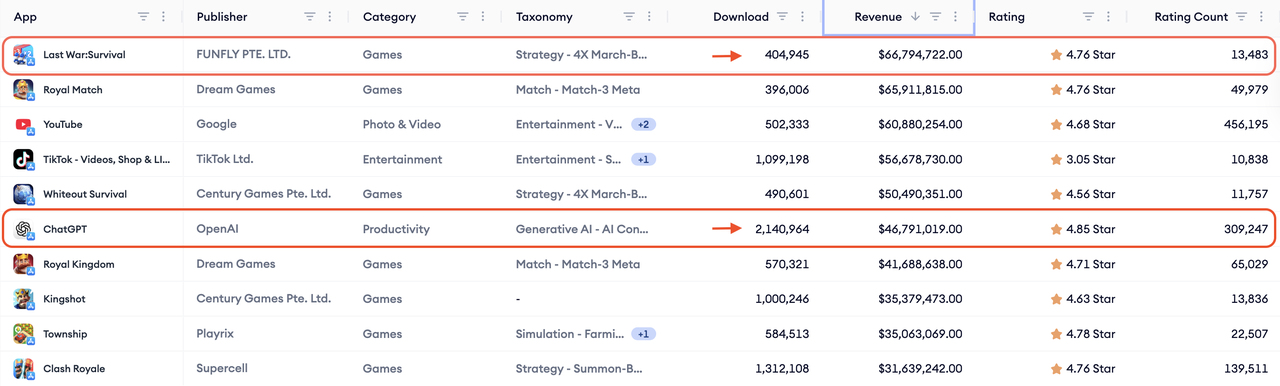

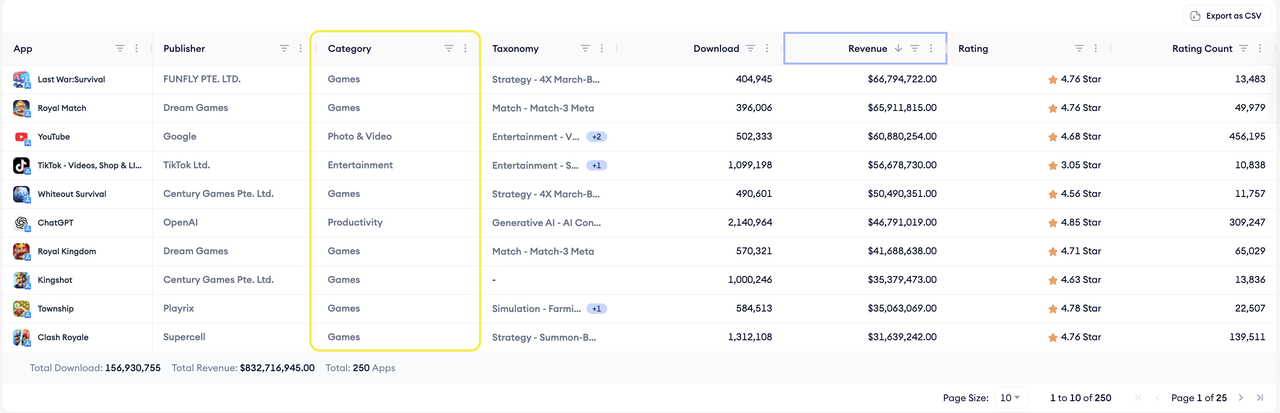

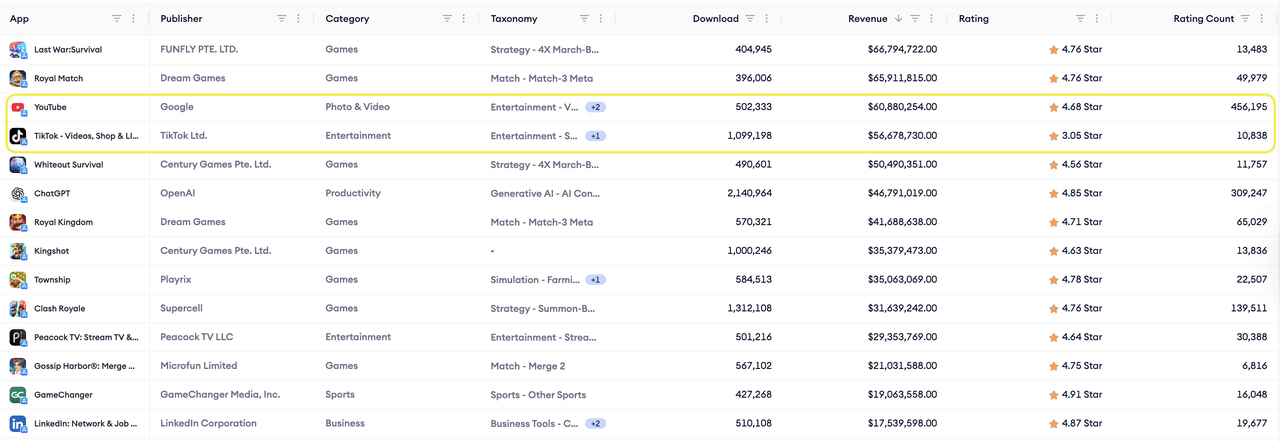

As you can see in the dashboard view below, in the revenue-sorted Top Apps view, several top-earning apps have far fewer downloads than the most-installed apps.

- Last War: Survival shows 404,945 downloads and $66,794,722 revenue.

- ChatGPT shows 2,140,964 downloads and $46,791,019 revenue.

✴️ Pro tip: That’s the core lesson; 5x more downloads does not guarantee more revenue. If you’re researching the most profitable apps, this is exactly the signal to look for.

App categories that make the most money

When revenue is viewed at the category level rather than the individual app level, clearer and more repeatable patterns emerge. MobileAction’s Market Intelligence shows that certain categories consistently appear in grossing rankings, even when they are not the most competitive in terms of downloads. These categories share one defining trait: users enter them with an expectation to pay.

Below, we break down the app categories that most reliably generate revenue and explain why their monetization dynamics differ.

Mobile games with in-app purchases

Mobile games remain one of the strongest revenue drivers in app marketplaces, particularly those built around in-app purchases rather than ads alone. This is not just a chart-level observation. According to Statista’s 2025 report, global revenue in the mobile games market is projected to reach US$126.06 billion, with an average revenue per user (ARPU) of US$60.14 worldwide. These figures help explain why gaming continues to dominate grossing rankings across app stores.

In MobileAction’s Market Intelligence, games frequently appear among top-grossing apps even when they are not leading free downloads. This reflects a common pattern in gaming monetization; most players never pay, but a small group of dedicated users spends repeatedly and generates the majority of the game’s revenue.

Games that monetize successfully tend to:

- Encourage repeated spending through progression systems

- Offer purchasable advantages, customization, or time acceleration

- Create long-term engagement loops rather than one-off sessions

Because a subset of highly engaged users drives revenue, download volume becomes less important than player lifetime value. This explains why some games with modest install numbers still outperform more popular titles in grossing rankings.

This follows the same pattern discussed earlier: revenue is driven by willingness to pay, not scale.

Subscription apps (fitness, dating, productivity)

Subscription apps are applications that generate revenue through recurring monthly or annual payments, rather than one-time purchases or ad impressions. In this model, revenue growth depends less on raw download volume and more on continued usage and long-term perceived value.

These apps serve users who are trying to solve an ongoing problem or improve a measurable outcome. In app categories such as fitness, dating, and productivity, users are not casually browsing, they are investing in progress. That makes recurring payment feel justified.

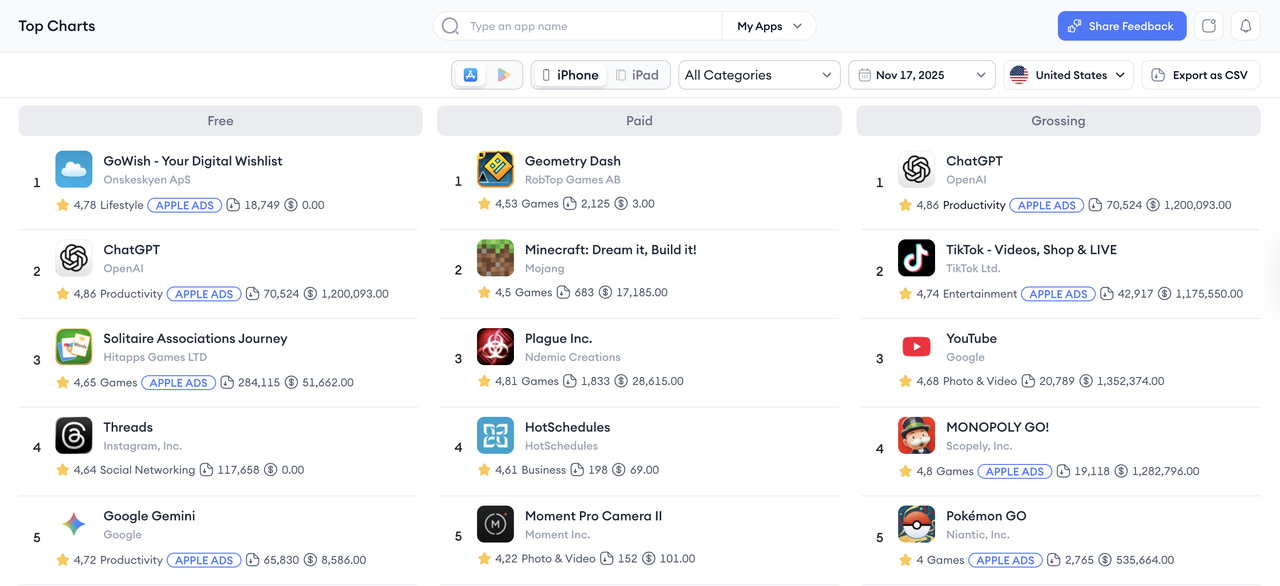

This pattern is visible in MobileAction’s Top Charts. For example, ChatGPT (Productivity) appears as a top-revenue app while relying primarily on a subscription model rather than ad monetization. Its position illustrates a broader trend: subscription-based productivity apps can generate substantial revenue without dominating free download charts.

Across fitness, dating, and productivity categories, subscription apps tend to:

- Grow revenue steadily rather than through short-term spikes

- Retain paying users across multiple billing cycles

- Appear more stable in grossing rankings than in free charts

The key insight is simple: Subscription apps do not need massive scale to generate strong revenue.

Finance and investing apps

Finance and investing apps appear in revenue-focused views for a different reason: trust and transaction value.

Users who rely on financial apps interact with them frequently and make decisions involving real money. This creates opportunities for monetization through:

- Premium features

- Subscription tiers

- Transaction-related fees

While finance apps may not always dominate free charts, their presence in grossing rankings reflects higher revenue per user.

Streaming and content apps

Streaming and content apps primarily monetize through subscriptions, but their revenue mechanics differ from productivity or fitness apps. Users are not paying to complete a task or reach a measurable goal. They pay for ongoing access to content, entertainment, and discovery.

This pattern is clearly visible in MobileAction’s Market Intelligence → Top Apps when the table is filtered by Revenue. In this view, large content platforms such as YouTube and TikTok appear among the highest-earning apps, despite offering free core experiences and not consistently leading download rankings.

The Top Apps (Revenue) view shows a clear monetization split in content platforms:

- Free access for casual consumption and scale

- Paid tiers that remove limits, unlock premium features, or enhance the experience

In the same revenue-filtered list, streaming and content apps tend to demonstrate:

- Strong grossing performance once they reach sufficient scale

- More stability than purely ad-driven media apps

- Predictable revenue levels after subscription adoption plateaus

Users do not subscribe for a single feature. They subscribe to continued access to a content library or ecosystem. As a result, long-term revenue depends less on acquisition spikes and more on content freshness, personalization, and churn management. When new value is added consistently, subscription revenue becomes recurring and forecastable.

How do top apps make money?

Three models appear most often among top earners: subscriptions, in-app purchases, and hybrid approaches. Each works under different conditions, and the data shows clear limits to ad-only monetization.

Subscriptions vs in-app purchases vs ads

Subscriptions and in-app purchases dominate grossing rankings for a reason: they align revenue with continued usage.

Subscription models convert ongoing value into predictable monthly or annual payments. Apps using this model benefit when users return regularly and integrate the product into their routine. As seen in MobileAction’s Top Charts, subscription apps tend to hold their positions over time rather than fluctuating rapidly.

In-app purchases, common in mobile games, work differently. Revenue is not evenly distributed across users. Instead, a small group of highly engaged users generates the majority of income. This model performs best when apps are designed around long-term progression, unlockable content, or competitive dynamics.

Ad-based monetization, by contrast, depends heavily on scale. While ad-supported apps perform well in Free Download Charts, they are far less visible in grossing rankings. Ads can generate revenue, but only when user volume and engagement are extremely high.

The contrast between Free and Grossing Charts highlights this difference clearly:

- Ads reward reach

- Subscriptions and IAPs reward commitment

Most profitable app ideas you can still build

At first glance, grossing rankings can feel discouraging. Many of the top-earning apps are well-known products with large user bases and years in the market. But the revenue patterns behind these rankings tell a different story.

Profitability is not limited to market leaders. What matters most is solving a real problem for a specific audience and choosing a monetization model that fits how users actually use the app. The app ideas below are not detailed product concepts. They represent revenue-focused directions based on patterns that consistently perform well in the market.

High-revenue app ideas for startups

Startups are rarely positioned to compete on scale. They can, however, compete on focus and willingness to pay.

High-revenue opportunities tend to exist where:

- Users face a recurring problem

- The solution saves time, reduces effort, or improves outcomes

- Paying feels rational rather than optional

This is why narrowly focused productivity tools, specialized fitness programs, or tools designed for specific professional workflows can generate meaningful revenue without massive install numbers.

A smaller, clearly defined audience with high intent is more valuable than a broad, low-intent user base.

Niche apps with fewer users but higher payments

One of the strongest signals in revenue rankings is the performance of niche apps. These apps rarely appear at the top of Download Charts, yet they maintain visible positions in grossing lists.

Niche apps succeed because:

- They serve users with a specific, high-value need

- Their pricing reflects depth, not mass appeal

- Users are less price-sensitive when the app fits their workflow

Examples vary by category, from advanced fitness planning to specialized content platforms, but the underlying logic is the same. When an app becomes a tool rather than a novelty, users tolerate higher prices and longer commitments.

B2C vs B2B apps in 2026

Revenue patterns also differ noticeably between consumer-focused and business-focused apps.

B2C apps tend to rely on:

- Emotional engagement

- Habit formation

- Large user bases with segmented monetization

B2B or professional apps, on the other hand, monetize through:

- Clear productivity gains

- Feature depth

- Higher price points per user

While B2B apps may have fewer users, their revenue per user is significantly higher. This helps explain why some tools with limited visibility in free charts still appear in revenue-focused rankings.

The key takeaway from this section is simple:

You do not need to build the next mass-market app to build a profitable one. You need an app that aligns problem severity, usage frequency, and monetization model.

How to choose the right app idea for profit

Understanding what apps make the most money is only useful if it helps you make better decisions before you build. The patterns visible across categories, monetization models, and revenue rankings point to a set of practical questions that consistently separate profitable apps from those that struggle to monetize.

Questions to ask before building an app

Before choosing an app idea, the most important question is not “Will people download this?” but “Will the right people pay for this?”

The revenue patterns discussed earlier suggest you should be able to answer the following clearly:

- What problem does this app solve on a recurring basis?

- How often will users realistically return?

- At what point does payment feel justified rather than forced?

- Does the app create ongoing value, or is it mostly one-time utility?

Apps that perform well in grossing rankings have clear answers to these questions. Apps that struggle rely on vague engagement assumptions or deferred monetization.

If you cannot articulate why a user would keep paying after the first week, the revenue ceiling is likely low.

Matching app type with monetization model

Not every monetization model fits every app. One of the most common mistakes is choosing a revenue strategy that conflicts with user behavior.

Based on observed market patterns:

- Habit-forming apps align well with subscriptions

- Progression-based experiences favor in-app purchases

- Utility apps with occasional use struggle with paid models unless the value is exceptional

- Ad-only monetization requires scale that most new apps never reach

Successful apps choose monetization after understanding usage patterns, not before. MobileAction Top Charts reflect this alignment repeatedly: apps that monetize well do so in ways that match how users actually engage.

Common mistakes that limit app revenue

Several mistakes appear consistently among apps that fail to convert usage into income:

- Prioritizing downloads over retention

- Relying entirely on ads without a clear path to paid value

- Launching with monetization that feels disconnected from core usage

- Competing in crowded categories without differentiation or pricing power

These mistakes are visible indirectly in the gap between free and grossing charts. Many apps achieve visibility but never cross the threshold into sustainable revenue.

The most important conclusion from this guide is not about specific apps or categories. It’s about alignment.

Apps make the most money when problem, usage, and monetization reinforce each other.

When they don’t, even strong adoption fails to translate into profit.

That principle holds across categories, platforms, and business models, and it is the most reliable insight visible across MobileAction’s Market Intelligence data.

Conclusion

When you strip away rankings and headline numbers, one pattern holds across iOS and Google Play: apps make money by monetizing behavior, not by maximizing downloads.

The highest-earning apps solve recurring problems, are used frequently, and charge in ways that feel justified to users. That is why mobile games with in-app purchases, subscription-based fitness and productivity apps, finance tools, and content platforms dominate grossing charts even when they are not the most downloaded.

The gap between free and grossing rankings reinforces a simple reality. Apps that align problem severity, usage frequency, and monetization consistently outperform those that chase scale without a revenue strategy.

If you want to validate these patterns for your own app idea, you can explore category-level revenue trends and top-grossing apps using MobileAction’s Market Intelligence. You can sign up today for free to start analyzing the market and use ASO Intelligence when you’re ready to go deeper into competition, keywords, and positioning.

The takeaway is straightforward: you don’t need the most downloads to build a profitable app, you need the right users, the right behavior, and the right way to monetize it.

Frequently asked questions

What mobile app categories are the most profitable?

The most profitable mobile app categories are those where users expect to pay and return regularly. Across app store revenue rankings, this includes subscription-based apps (such as fitness, dating, and productivity), mobile games with in-app purchases, finance and investing apps, and streaming or content platforms.

These categories outperform others because they support recurring payments or repeat spending. Users in these segments are not only active, but also willing to pay over time, which leads to higher revenue per user compared to categories that rely primarily on free usage or one-time engagement.

How do apps make money without ads?

Apps make money without ads by charging users directly for value. The most common approaches are subscriptions, in-app purchases, and paid premium features.

Subscription models work well for apps that deliver ongoing value, such as productivity tools or content platforms. In-app purchases are especially effective in games, where users pay to progress faster, unlock features, or personalize their experience. Some apps combine free access with optional paid upgrades, allowing them to monetize engaged users without interrupting the experience with ads.

This direct-payment approach usually results in higher revenue per user than ad-based models, even with a smaller audience.

Do free apps or paid apps make more money overall?

Free apps generate more installs, but paid and subscription-based apps generate more predictable and sustainable revenue. App store grossing data shows that apps charging users directly tend to outperform free apps in long-term revenue, even with smaller audiences. The key difference is revenue per user, not reach.