Looking to boost your app's visibility and acquire more users? Our 2025 ASO Report is your ultimate guide to navigating the evolving app store landscape. Packed with data-driven insights, keyword trends, and top-ranking app strategies, this report will equip you with the knowledge to optimize your app's presence and achieve organic growth.

If there was one thing 2025 made crystal clear, it’s that app growth has become less about isolated optimizations and more about connected decisions. ASO affects paid performance. Paid timing affects organic visibility. Automation only works if the data behind it is reliable. And none of it scales if teams are forced to stitch insights together manually.

At MobileAction, this understanding shaped everything we built this year.

Rather than chasing individual feature launches, our goal in 2025 was to remove the gaps between insight, action, and outcome across ASO, Apple Ads, and analytics. Every improvement, redesign, and new capability was built to answer a single question: how can teams make better decisions faster, without adding complexity to their workflows?

Making ASO Intelligence deeper without making it harder

ASO has shifted away from isolated keyword optimization. Today, it’s about understanding visibility, creatives, competition, localization, and store performance as a living system. Throughout 2025, we reshaped ASO Intelligence to reflect that reality.

New plans to empower teams of all sizes

One of the most foundational changes we made this year was introducing ASO plans for the first time. Previously, ASO Intelligence was available through enterprise pricing, which limited how many teams could access and scale ASO work independently. Moving to self-serve plans opened ASO Intelligence to a much broader range of teams and growth stages.

As adoption grew, it reinforced an important insight: access alone wasn’t enough. ASO research is continuous, and rigid plans or static quotas interrupt momentum. That’s why we introduced more flexible plans to better support continuous discovery, experimentation, and iteration, instead of forcing teams to pause or work around limits.

Updated interface and tools

At the same time, we simplified how users move through the platform and updated the side menu navigation to better match real ASO workflows. As ASO workflows expand, speed matters. Reducing friction between tools meant users could spend less time navigating and more time analyzing and acting.

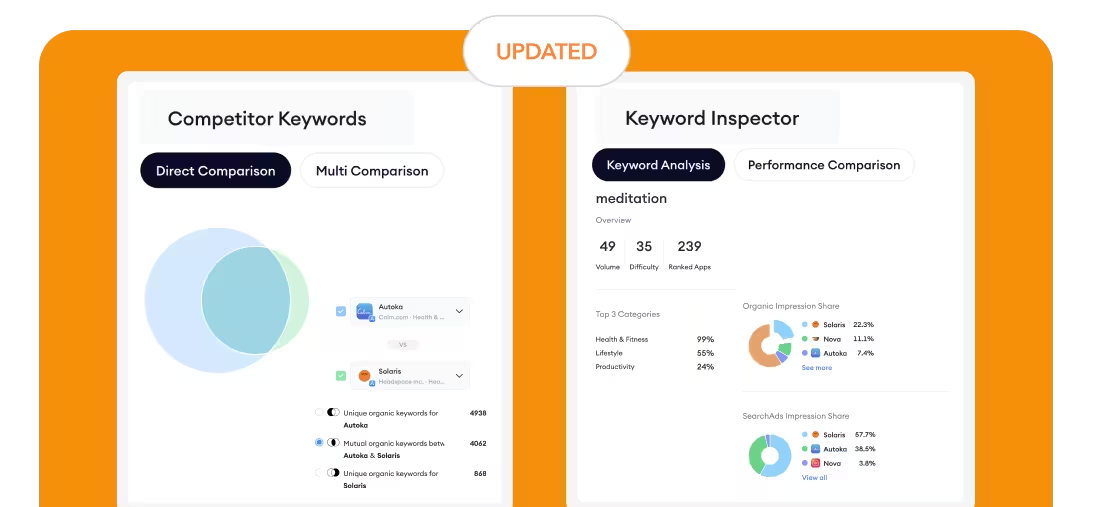

Within the tools themselves, the focus was on clarity. ASO Overview was built as a true starting point for understanding where an app stands. Keyword Tracking and Keyword Inspector were refined to surface movement and opportunity more clearly, while Competitor Keywords evolved into a more strategic view of where visibility is being won or lost across the market.

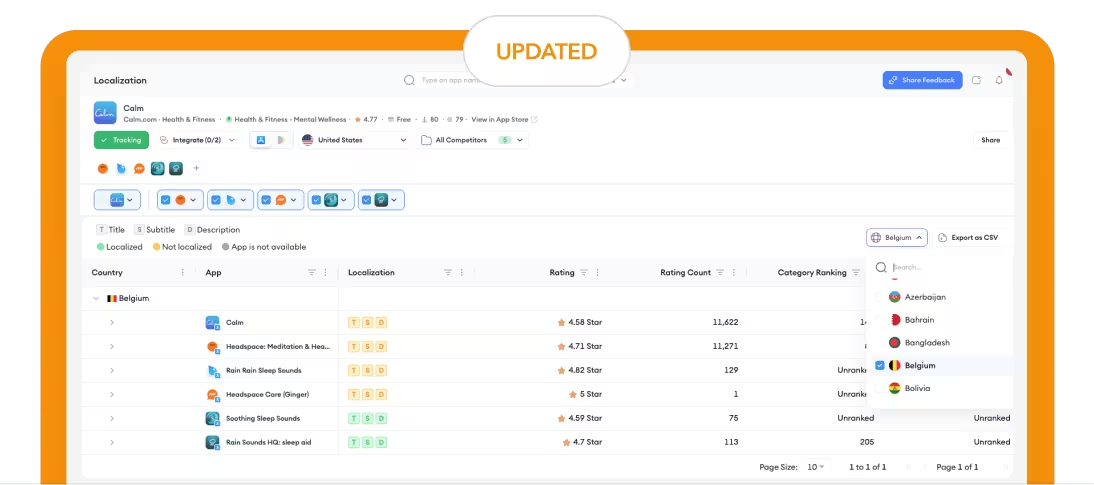

The Localization tool received a UI update to improve usability and navigation. The refreshed interface makes it easier for teams managing multiple countries to understand, review and work with localization data. App Update Timeline improvements added another layer, making it easier to link store changes with performance impact over time.

Stronger app analytics to support ASO decisions

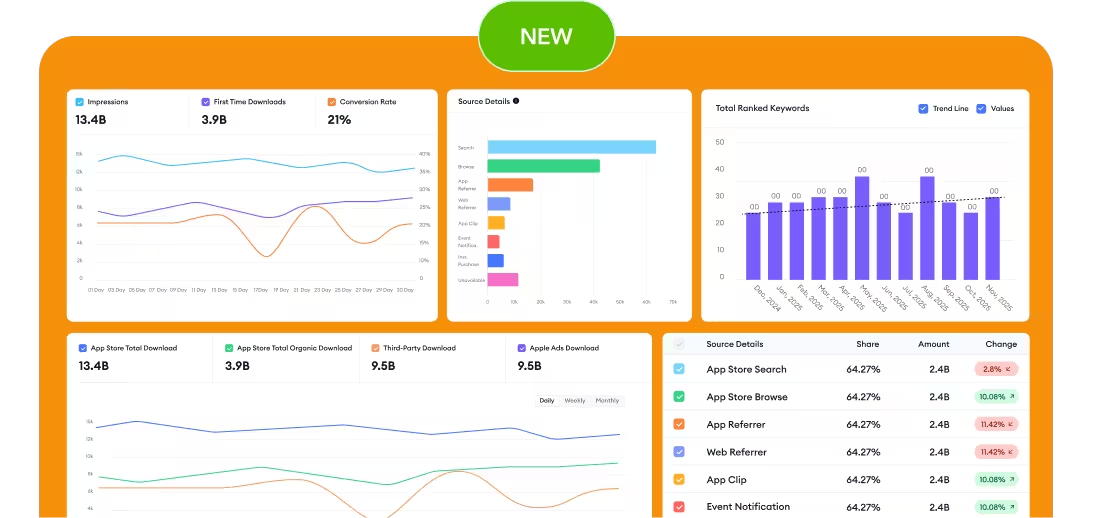

To complete the picture, we strengthened the ASO workflow with Store Analytics, bringing visibility and performance closer together. With AI-powered insights, teams can more easily understand how their apps are performing, without having to piece data together across multiple views. Bringing revenue data into the ASO workflow made it possible to evaluate impact beyond download volume, and to prioritize optimization efforts based on business outcomes.

The impression-to-first-time download funnel adds another layer of clarity, helping teams see how store visibility turns into installs and where potential drop-offs occur. By viewing organic and paid acquisition side by side, Store Analytics also makes it easier to understand how ASO and Apple Ads influence one another, supporting more informed, integrated decisions.

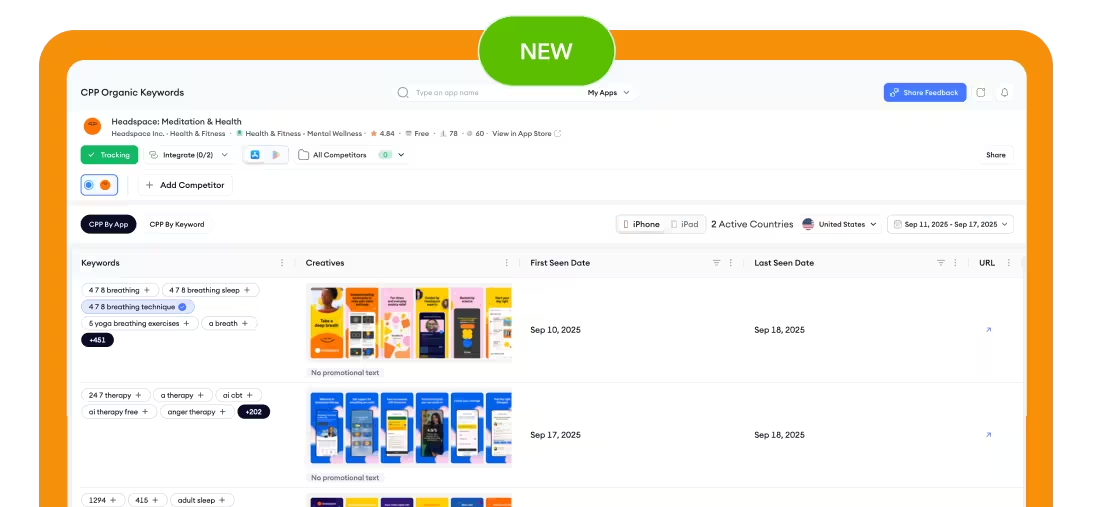

Industry’s first organic custom product pages intelligence

With the launch of Organic CPP Results, teams gained access to insights that simply weren’t available elsewhere. For the first time, it became possible to understand how custom product pages perform organically, not just in paid contexts, closing a blind spot in ASO strategy and enabling more informed creative and messaging decisions.

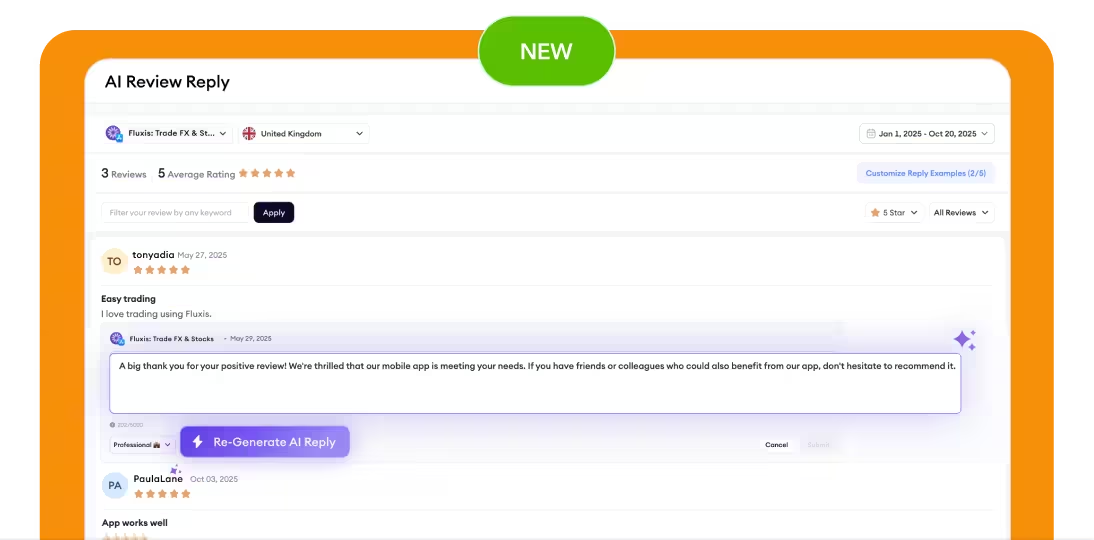

Review management with AI

Finally, we also introduced AI-powered review replies to help teams manage one of the most time-consuming parts of store optimization. The goal wasn’t to replace human judgment, but to remove repetitive work, allowing teams to respond faster, stay consistent, and protect brand voice at scale.

Turning complexity into control with SearchAds.com

If ASO improvements in 2025 were about depth, SearchAds.com improvements were about control at scale.

Apple Ads is becoming more operationally intensive with more countries, more placements (as per the latest news), more campaigns running simultaneously. Managing that operational load manually is never sustainable. So that’s why automation, timing, and structure was our core focus.

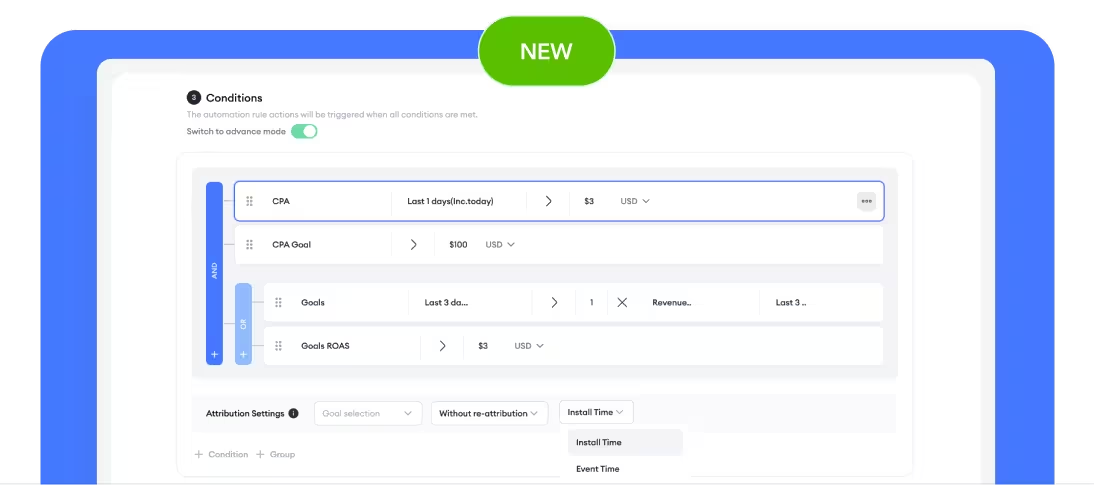

Automation that responds to changing conditions

We always aim to extend Automations to support smarter decision-making. Introducing event-time optimization meant actions could be triggered by performance moments and not just static rules. Adding automation based on Apple Ads Share of Voice comparisons allowed teams to respond automatically when visibility shifted, rather than discovering issues after the fact.

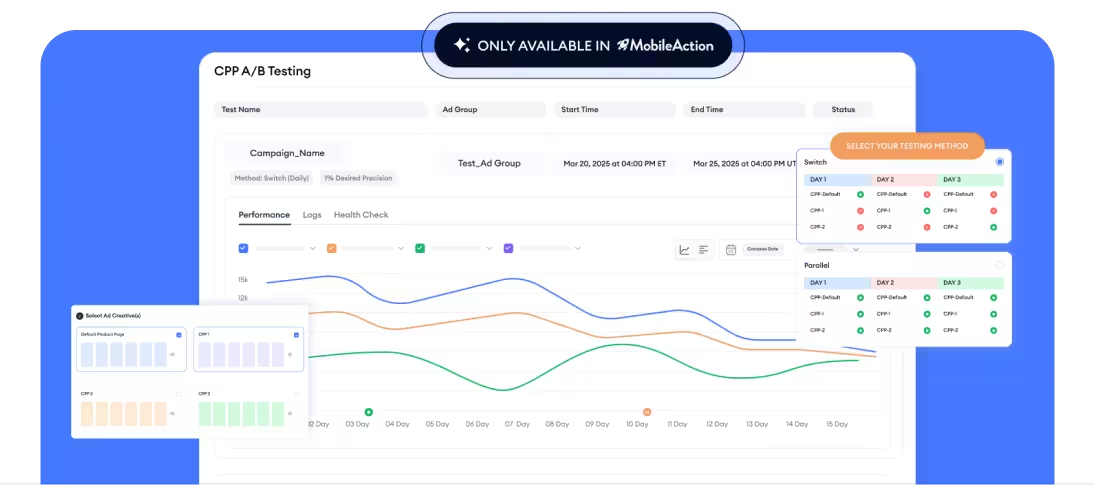

Introducing and strengthening optimization tools

On the execution side, we continued to invest in tools that simplify large-scale operations. CPP A/B Testing (one and only in the industry) made it easier to validate creative and messaging choices with confidence. Smart Bidding was extended to support multiple campaigns, ad groups, and countries, ensuring optimization didn’t break as accounts grew. Budget scheduling under the very much loved Budget Allocation added time into the optimization equation, recognizing that when you spend is just as important as where you spend.

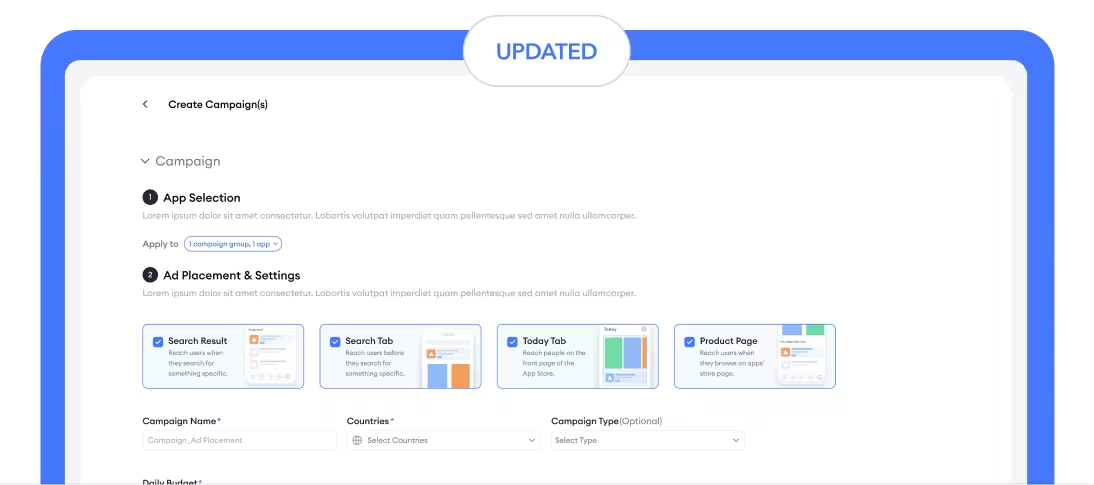

More control across campaign creation and reporting

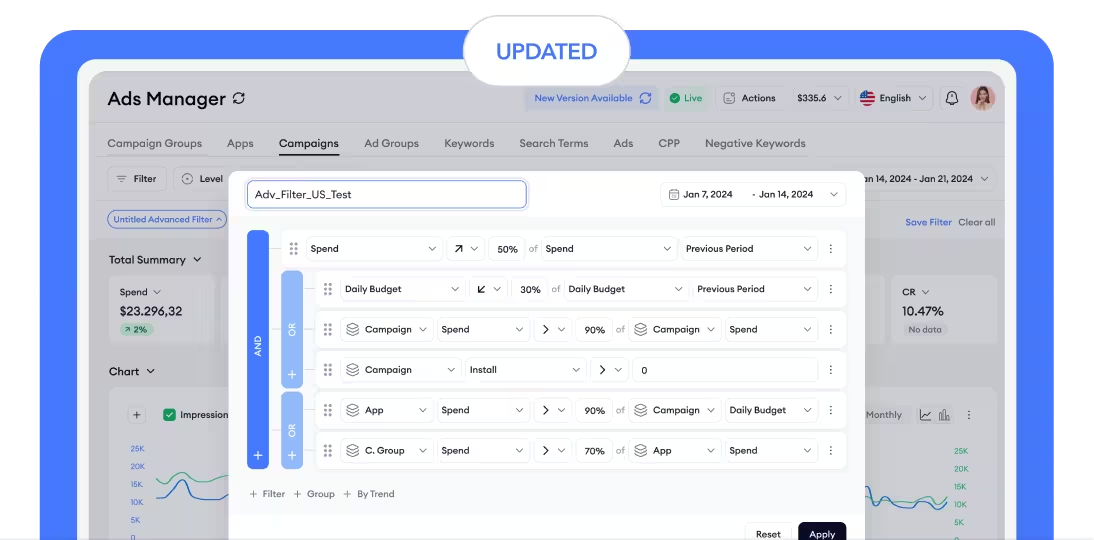

Campaign creation and analysis also evolved. Multi-placement campaign creation reduced setup friction, while segmented performance views with pivot tables allowed teams to analyze results from any angle.

Advanced filters and trend-based filtering helped surface patterns early, reducing further the need to manually scan large datasets for signals. By highlighting meaningful shifts in performance, teams could focus their attention where it mattered most. Combined with hourly data in Ads Manager, these features enabled more informed decisions around timing and execution.

To keep teams aligned, scheduled reports turned insights into a shared, automated source of truth without manual exporting or follow-ups.

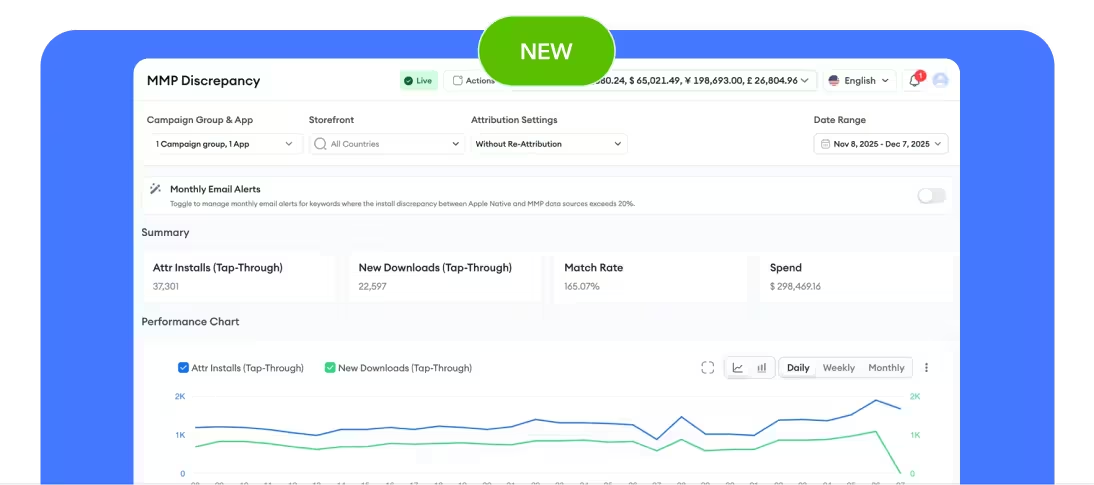

And because optimization only works when data is trusted, we launched the MMP Discrepancy dashboard. By bringing Apple Ads and MMP data together in one view, teams can now monitor discrepancies continuously and understand what’s happening, before misalignment turns into misinformed decisions.

So what did all of this add up to?

Looking back, 2025 was about connecting the dots.

ASO insights now flow more naturally into paid decisions. Paid performance is easier to analyze, automate, and trust than ever. Timing, visibility, and competition are no longer separate conversations, they’re part of the same system. And that system is built to scale with how app growth teams actually work today.

That shift is already reflected in how the platform is being used. In 2025, MobileAction supported the management of more than $1 billion in Apple Ads spend, with noticeable changes in budget distribution.

Looking closer at category-level trends, changes in ad spend reflected the addition of new enterprise customers and expanding partnerships in 2025. Productivity and Utilities emerged as the largest spenders, each showing dramatic year-over-year growth of over 1,400%, a shift closely aligned with the rapid adoption of AI-powered tools designed to improve everyday productivity. Photo & Video also saw a significant increase of over 1,000%. Gaming continued to be a high-volume category for our portfolio, with spend largely stabilizing year over year as advertisers prioritized performance in a mature and competitive market. Finance spend increased by nearly 73%, as crypto-related platforms regained momentum and more apps entered the market to simplify financial workflows and improve access to digital financial services.

We also saw deep adoption among enterprise teams managing large budgets and global operations. In 2025, MobileAction expanded its enterprise customer base with brands such as Google, Meta, Spotify, Starbucks, and Grammarly, joining a growing group of companies relying on the platform to bring structure and clarity to app growth.

Taken together, these signals reflect how the platform is being used in practice, not as a collection of features, but as a system built to handle scale, complexity, and real-world decision-making.

And as we head into 2026, that foundation puts us in a strong position to keep moving forward, bridging signals faster, reducing friction, and supporting growth at scale.

Looking ahead to 2026

If 2025 was about connecting the dots, 2026 is shaping up to be about moving faster between them.

One of the clearest signals came recently, with Apple announcing new ad placement opportunities in search results starting in 2026. While details are still limited, it’s a meaningful shift. More placements will change how visibility is distributed, how competition plays out, and how timing and relevance are optimized.

This change indicates that Apple Ads continues to grow as a channel, with engagement increasing and new inventory opening up. At the same time, investment in AI-driven products in the app marketing industry shows no signs of slowing down, creating momentum across the industry and accelerating expectations around automation and intelligence.

On a broader level, signals of easing interest rates and monetary expansion point toward renewed advertising investment globally. While economic and political dynamics will always shape how markets behave, current indicators suggest continued opportunity rather than contraction.

Taken together, these shifts point to a clear reality for 2026: growth teams will be operating in an environment with more signals, more surfaces, and more decisions to make, often in less time. For teams running Apple Ads, new placements add another layer of complexity, reinforcing the need for stronger structure, better automation, and clearer decision-making frameworks.

For us, this current state doesn’t signal a change in direction, but a validation of it. Everything we’re building and we have in our roadmap is focused on helping teams adapt to changing dynamics, bring signals together across channels, and stay in control as the landscape continues to evolve.

Why “useful AI” matters more than “visible AI”

AI continues to dominate industry conversations, but for many teams, the gap between promise and practice remains. The challenge isn’t a lack of intelligence, it’s applying that intelligence in ways that genuinely reduce the decision burden instead of adding to it.

Our approach to AI in 2026 is grounded in that gap.

AI at MobileAction is not about adding another layer of interface or introducing novelty features. It’s about embedding intelligence directly into how decisions are made. Over the past year, we focused on building the infrastructure required to support this shift. That groundwork allows us to move forward with AI capabilities that don’t sit on top of workflows, but work within them and support optimization, prioritization, and execution.

This means bidding decisions informed by broader performance signals. It means recommendations that are context-aware, working like an expert and drawing from ASO intelligence and paid performance together rather than treating them as separate worlds. And it means guidance that reduces decision fatigue, especially for teams that don’t have the time or resources to constantly monitor every moving part.

Rather than asking users what to optimize next, the system increasingly helps answer that question itself, combining keyword intelligence, performance trends, and market trends into clearer next steps for both organic and paid app marketing.

This direction also reflects a broader goal: making advanced optimization accessible beyond large enterprise teams. As ASO plans opened the door for small and mid-sized teams in 2025, the next phase focuses on helping those teams operate with the same level of confidence and insight on every layer, without added twists and turns.

In short, our approach to AI is pragmatic by design, but that pragmatism is rooted in strong technical foundations. Rather than treating AI as a surface-level feature, we focus on building intelligence deeply into the systems that power decision-making. The goal isn’t visibility for its own sake, but durable impact: reducing manual effort, increasing signal quality, and enabling better decisions directly within existing workflows. When AI is doing its job well, teams feel the impact without having to think about the technology behind it.

Before we move on, thank you

None of what we built in 2025 happened in isolation. It was shaped by the teams who use MobileAction every day, the feedback they shared, and the challenges they trusted us to help solve. To our customers, partners, and everyone who builds, tests, and grows with us, thank you for being part of this journey.

Behind the scenes, this year was also a collective effort. From product and engineering to design, customer success, and marketing, the work that went into connecting the dots across ASO, Apple Ads, and analytics was truly a team effort. To the entire MobileAction team, thank you for the thoughtfulness, care, and ownership you brought to everything we built. The progress we made reflects not just what we shipped, but how closely we worked together to make it meaningful.

As we move into 2026, the direction is clear and so is the energy. With the foundations in place, the year ahead will be about momentum, execution, and shipping with purpose. 2026 is set to be a year of action, and we’re excited to keep building alongside the teams who continue to push app growth forward with us.

Let’s keep moving.